All about Pacific Prime

The Only Guide to Pacific Prime

Table of Contents6 Easy Facts About Pacific Prime ExplainedGet This Report on Pacific PrimePacific Prime Things To Know Before You Get ThisNot known Incorrect Statements About Pacific Prime Some Known Details About Pacific Prime

Your agent is an insurance professional with the expertise to direct you via the insurance process and assist you locate the most effective insurance security for you and the people and points you appreciate many. This post is for educational and recommendation objectives only. If the plan insurance coverage summaries in this write-up dispute with the language in the plan, the language in the policy applies.

Policyholder's deaths can additionally be contingencies, specifically when they are considered to be a wrongful fatality, in addition to home damage and/or destruction. Due to the uncertainty of claimed losses, they are labeled as backups. The insured person or life pays a costs in order to receive the benefits promised by the insurance provider.

Your home insurance coverage can assist you cover the problems to your home and pay for the cost of rebuilding or repair work. In some cases, you can likewise have insurance coverage for products or belongings in your house, which you can then purchase substitutes for with the cash the insurance policy company offers you. In the event of a regrettable or wrongful death of a sole income earner, a family's financial loss can possibly be covered by specific insurance plans.

The Best Strategy To Use For Pacific Prime

There are numerous insurance plans that consist of cost savings and/or financial investment schemes along with regular protection. These can aid with building savings and wide range for future generations through regular or reoccuring investments. Insurance coverage can aid your household maintain their standard of life on the occasion that you are not there in the future.

The most basic kind for this sort of insurance, life insurance policy, is term insurance coverage. Life insurance policy generally helps your household become secure financially with a payout quantity that is offered in the occasion of your, or the plan owner's, death during a details policy period. Kid Plans This kind of insurance policy is basically a savings instrument that assists with generating funds when children reach specific ages for seeking college.

Home Insurance policy This kind of insurance covers home problems in the events of mishaps, natural disasters, and incidents, together with various other comparable events. maternity insurance for expats. If you are wanting to seek payment for mishaps that have occurred and you are having a hard time to determine the proper path for you, reach out to us at Duffy & Duffy Law Practice

Get This Report about Pacific Prime

At our law practice, we comprehend that you are going through a whole lot, and we comprehend that if you are coming to us that you have actually been with a whole lot. https://iridescent-horse-hspdzg.mystrikingly.com/blog/welcome-to-pacific-prime. Due to that, we supply you a totally free assessment to go over your problems and see how we can best check these guys out help you

Due to the COVID pandemic, court systems have actually been shut, which adversely influences vehicle crash situations in a remarkable way. We have a great deal of skilled Long Island vehicle mishap lawyers that are enthusiastic about dealing with for you! Please contact us if you have any kind of questions or worries. expat insurance. Again, we are right here to aid you! If you have an injury claim, we wish to make certain that you get the settlement you are entitled to! That is what we are right here for! We happily offer the individuals of Suffolk Region and Nassau Area.

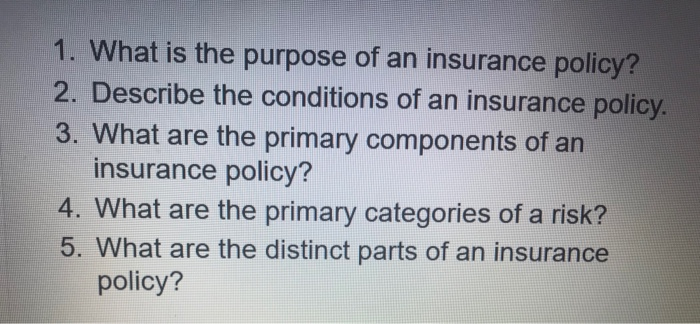

An insurance plan is a lawful agreement in between the insurance provider (the insurance company) and the individual(s), business, or entity being guaranteed (the insured). Reviewing your plan aids you confirm that the policy satisfies your demands which you understand your and the insurer's obligations if a loss happens. Lots of insureds buy a policy without recognizing what is covered, the exemptions that eliminate coverage, and the conditions that must be satisfied in order for coverage to use when a loss takes place.

It determines that is the insured, what threats or building are covered, the plan limitations, and the policy period (i.e. time the plan is in force). The Affirmations Page of a life insurance policy will certainly include the name of the individual insured and the face quantity of the life insurance coverage policy (e.g.

This is a recap of the major promises of the insurance policy firm and states what is covered.

The Buzz on Pacific Prime

Life insurance coverage plans are commonly all-risk plans. https://www.4shared.com/u/V2DOm1s8/pacificpr1me.html. The 3 significant types of Exclusions are: Excluded risks or reasons of lossExcluded lossesExcluded propertyTypical instances of excluded hazards under a homeowners policy are.